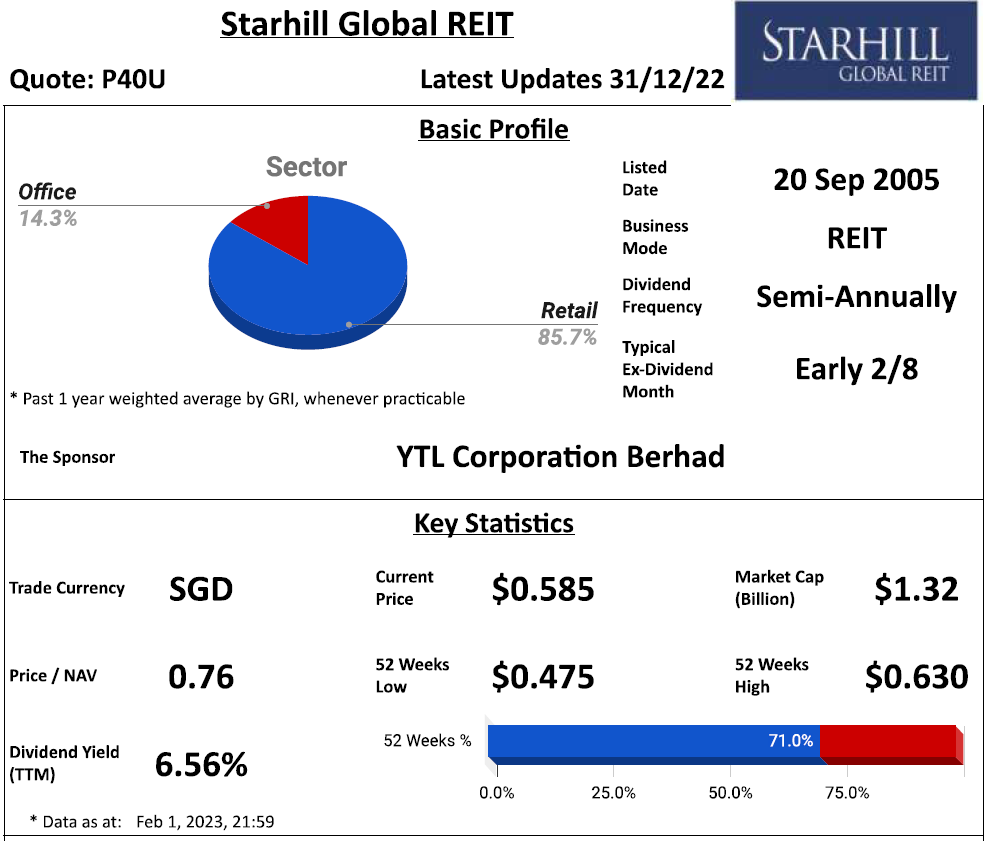

- Main Sector(s): Retail & Office

- Country(s) with Assets: Singapore, Australia, Malaysia, Japan & China

- No. of Properties (exclude development/associate/fund): 10

Key Indicators

- Distributable Income Breakdown:

- 96.4% from Operation

- 3.6% from Fees Paid/Payable in Units

- Distribution = 95% of Distributable Income

- Distribution to Perpetual Securities Holder = 4.2% of Distributable Income

Related Parties Shareholding

- REIT sponsor's shareholding: Above median for more than 20%

- REIT manager's shareholding: Above median for more than 20%

- Directors of REIT manager's shareholding: Below median for more than 20%

Lease Profile

- Occupancy: ± 5% from median

- WALE: Above median for more than 10%

- Highest lease expiry within 5 years: Above median for more than 20%; Falls in FY24/25

- Weighted average land lease expiry: Below median for more than 10%

Debt Profile

- Gearing ratio: ± 10% from median

- Gearing including perps: ± 10% from median

- Cost of debt: ± 10% from median

- Fixed rate debt %: Above median for more than 10%

- Unsecured debt %: ± 10% from median

- WADM: ± 10% from median

- Highest debt maturity within 5 years: Below median for more than 20%; Falls in FY25/26

- Interest coverage ratio: Below median for more than 10%

Diversification Profile

- Top geographical contribution: Above median for more than 10%

- Top property contribution: Above median for more than 20%

- Top 5 properties' contribution: Above median for more than 20%

- Top tenant contribution: Above median for more than 20%

- Top 10 tenants' contribution: Above median for more than 20%

Key Financial Metrics

- Property yield: ± 10% from median

- Management fees over distribution: Above median for more than 10%; $5.571 distribution for every dollar paid

- Distribution on capital: Below median for more than 10%

- Distribution margin: ± 10% from median

Trends

- Slight Uptrend: Occupancy

- Flat: Property Yield

- Slight Downtrend: Distribution Margin

- Downtrend: DPU, NAV per Unit, Interest Coverage Ratio, Distribution on Capital

Relative Valuation

- P/NAV: Above average for 1y & 3y; Average for 5y

- Dividend Yield: Average for 1y, 3y & 5y

Author's Opinion

| Favorable | Less Favorable |

|---|---|

| Diversified Sector | Low Directors of REIT Manager's Shareholding |

| High REIT Sponsor's Shareholding | Concentrated Lease Expiry |

| High REIT Manager's Shareholding | Low Interest Coverage Ratio |

| Long WALE | High Top Geographical Contribution |

| High Fixed Rate Debt % | High Top Property & Top 5 Properties Contributions |

| Well Spread Debt Maturity | High Top Tenant & Top 10 Tenants Contributions |

| Non-Competitive Management Fees | |

| Low Distribution on Capital | |

| DPU Downtrend | |

| NAV per Unit Downtrend | |

| Interest Coverage Ratio Downtrend | |

| Distribution on Capital Downtrend |

As compared to the previous half-yearly performance, DPU has declined from 2.02 cents to 1.82 cents. The decline mainly comes from the combination of NPI decline, interest cost increase, loss in derivative instruments, income tax increase (a lot) and a higher amount of retention. Moving forward, the performance of Singapore retail is expected to be improved given the border opening of China.

For more information, check out:

SREITs Dashboard - Detailed information on individual Singapore REIT

SREITs Data - Overview and details of Singapore REIT

REIT Review - List of previous REIT review posts

Singapore REITs Post Telegram Channel - Join to receive posts for Singapore REITs

REIT-TIREMENT Patreon - Support my work and get exclusive content

REIT-TIREMENT Facebook Page - Support by liking my Facebook Page

REIT Investing Community - Facebook Group where members share and discuss REIT topic

*Disclaimer: The information presented on this blog is for educational and informational purposes only. The materials, including research and opinions, are based solely on my own findings and should not be considered as professional financial advice or a definitive statement of fact. I cannot guarantee the accuracy, completeness, or reliability of the information provided. I shall not be held liable for any errors, omissions, or losses that may occur as a result of using the information presented on this blog. It should be noted that the information presented on this blog does not constitute a buy, sell, or hold recommendation for any security. It is crucial to conduct your own thorough research and due diligence before making any investment decisions.

No comments:

Post a Comment