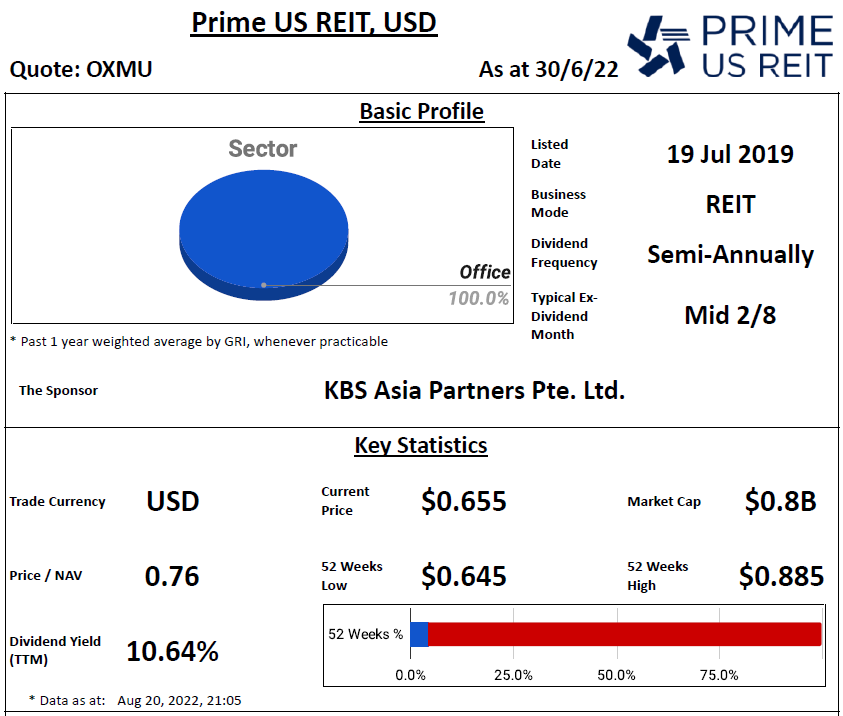

- Main Sector(s): Office

- Country(s) with Assets: United States

- No. of Properties (exclude development/associate/fund): 14

Key Indicators

Performance Highlight

- REIT sponsor's shareholding: Below median for more than 20%

- REIT manager's shareholding: Below median for more than 20%

- Directors of REIT manager's shareholding: Below median for more than 20%

Lease Profile

- Occupancy: Below median for more than 5%

- WALE: ± 10% from median

- Highest lease expiry within 5 years: Below median for more than 20%; Falls in 2025

- Weighted average land lease expiry: 100% freehold properties

Debt Profile

- Gearing ratio: ± 10% from median

- Cost of debt: Above median for more than 20%

- Fixed rate debt %: Above median for more than 10%

- Unsecured debt %: 0%

- WADM: Below median for more than 10%

- Highest debt maturity within 5 years: Above median for more than 20%; Falls in 2024

- Interest coverage ratio: Above median for more than 10%

Diversification Profile

- Top geographical contribution: Below median for more than 20%

- Top property contribution: Below median for more than 20%

- Top 5 properties' contribution: Below median for more than 10%

- Top tenant contribution: Below median for more than 20%

- Top 10 tenants' contribution: ± 10% from median

Key Financial Metrics

- Property yield: Above median for more than 20%

- Management fees over distribution: Below median for more than 20%; $9.80 distribution for every dollar paid

- Distribution on capital: Above median for more than 20%

- Distribution margin: ± 10% from median

Trends

- Flat: DPU, NAV per Unit, Distribution Margin

- Slight Downtrend: Interest Coverage Ratio, Distribution on Capital

- Downtrend: Occupancy, Property Yield

Relative Valuation

- P/NAV: Below -1SD for 1y, 3y & 5y

- Dividend Yield: Above +2SD for 1y, 3y & 5y

Author's Opinion

| Favorable | Less Favorable |

|---|---|

| Well Spread Lease Expiry | Low REIT Sponsor's Shareholding |

| 100% freehold properties | Low REIT Manager's Shareholding |

| High Fixed Rate Debt % | Low Directors of REIT Manager's Shareholding |

| High Interest Coverage Ratio | Low Occupancy |

| Low Top Geographical Contribution | High Cost of Debt |

| Low Top Property & Top 5 Properties Contributions | 0% Unsecured Debt |

| Low Top Tenant Contribution | Short WADM |

| High Property Yield | Concentrated Debt Maturity |

| Competitive Management Fees | Occupancy Downtrend |

| High Distribution on Capital | Property Yield Downtrend |

Performance is similar to the previous quarter and the occupancy has declined slightly again. The good thing is that PRIME achieved positive rental reversion for the last 8 quarters (exclude those leases lesser than 1 year). DPU is able to maintain probably due to high rental revision as well as amortized termination fees of WeWork, which will cover the lease payments through to mid-4Q 2022.

You could also refer below for more information:

SREITs Dashboard - Detailed information on individual Singapore REIT

SREITs Data - Overview and Detail of Singapore REIT

REIT Analysis - List of previous REIT analysis posts

Singapore REITs Post Telegram Channel - Join to receive posts for Singapore REITs

REIT-TIREMENT Patreon - Support my work and get exclusive contents

REIT-TIREMENT Facebook Page - Support by liking my Facebook Page

REIT Investing Community - Facebook Group where members share and discuss REIT topic

*Disclaimer: Materials in this blog are based on my research and opinion which I don't guarantee accuracy, completeness, and reliability. It should not be taken as financial advice or a statement of fact. I shall not be held liable for errors, omissions and loss or damage due to the use of the material in this blog. Under no circumstances does the information presented on this blog represent a buy, sell, or hold recommendation on any security, please always do your own due diligence before any decision is made.

No comments:

Post a Comment