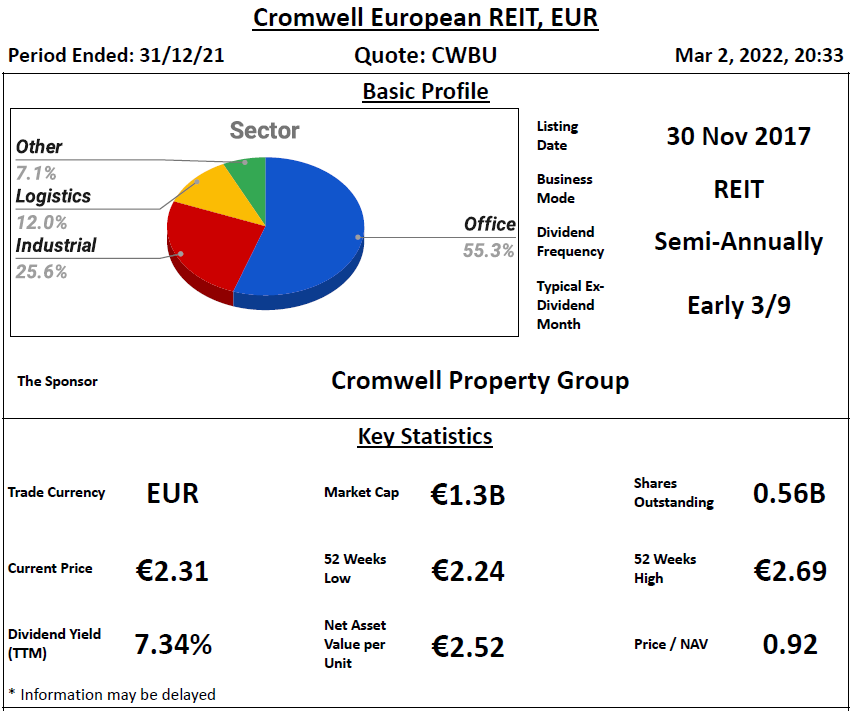

Basic Profile & Key Statistics

Performance Highlight

In December, CEREIT has completed the acquisition of 3 properties in U.K. and Netherlands.

- REIT sponsor's shareholding is slightly high at 27.905%

- REIT manager's shareholding is low at 0.383%

- Directors of REIT manager's shareholding is low at 0.02%

Lease Profile

- Occupancy is slightly high at 95%

- WALE is slightly long at 4.6 years

- Highest lease expiry within 5 years is high at 33.6% which falls in 2022

- Weighted average land lease expiry is long at 93.84 years

Debt Profile

- Gearing ratio is moderate at 36.6%, including perps, gearing ratio is at 39.1%

- Cost of debt is low at 1.72%

- All debts are fixed-rate debts

- Unsecured debt is high at 91%

- WADM is long at 3.4 years

- Highest debt maturity within 5 years is high at 54%, which falls in 2025

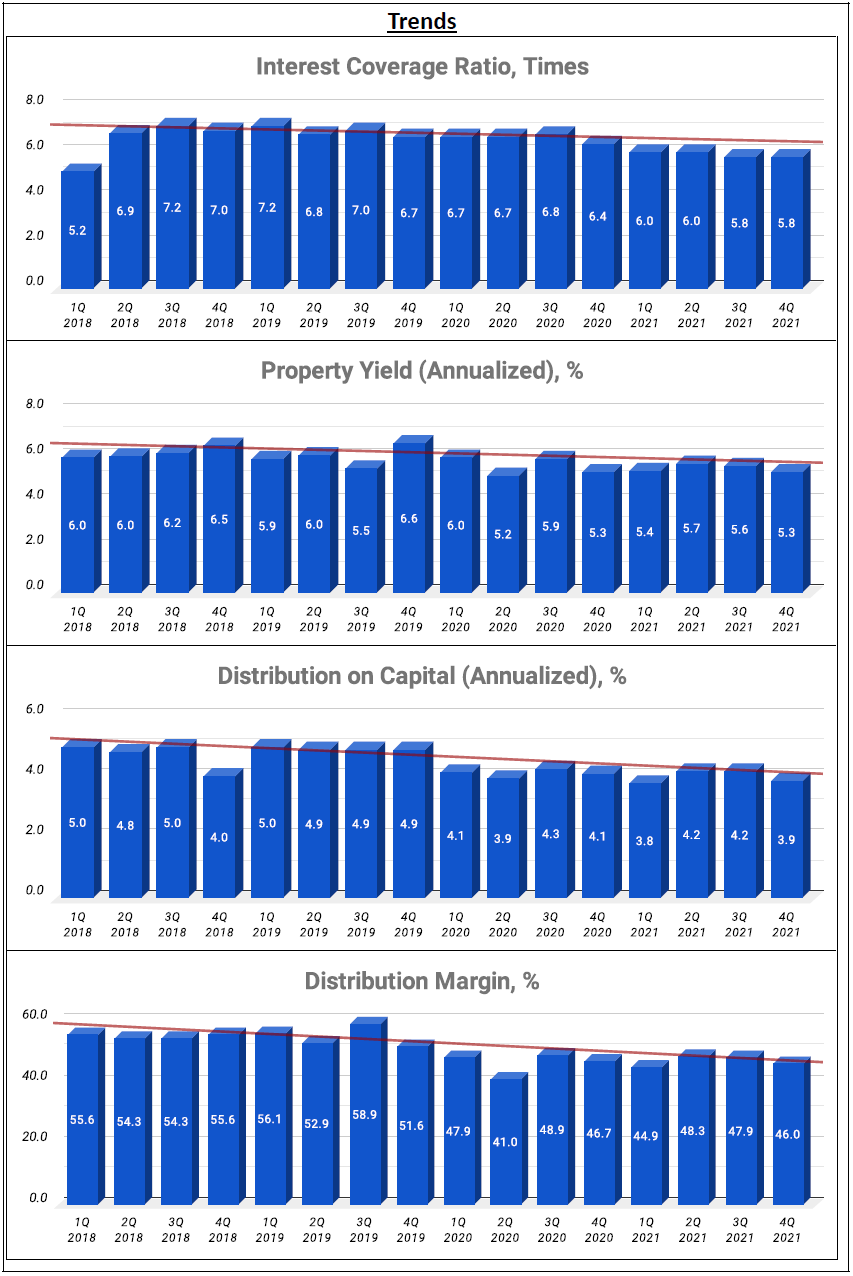

- Interest coverage ratio is high at 5.8 times

Diversification Profile

- Top geographical contribution is low at 8.4%

- Top property contribution is low at 7.8%

- Top 5 properties contribution is low at 28.9%

- Top tenant contribution is moderate at 11.9%

- Top 10 tenants contribution is low at 31.2%

- Top 3 countries contribution is from Netherlands, Italy and France which contribute around 2/3 of GRI

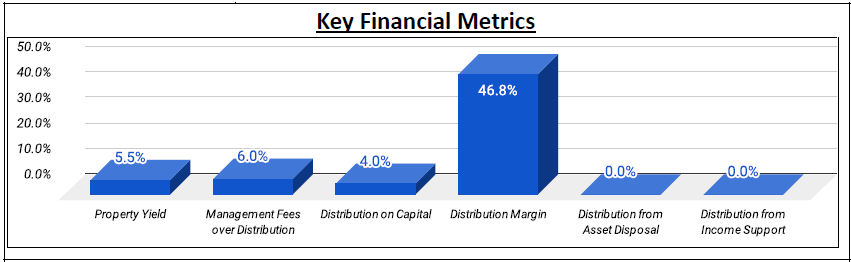

Key Financial Metrics

- Property yield is slightly high at 5.5%

- Management fees over distribution is low at 6% in which unitholders receive £ 16.67 for every pound paid

- Distribution on capital is high at 4%

- Distribution margin is moderate at 46.8%

Trends

- Downtrend - DPU, NAV per Unit, Interest Coverage Ratio, Property Yield, Distribution on Capital, Distribution Margin

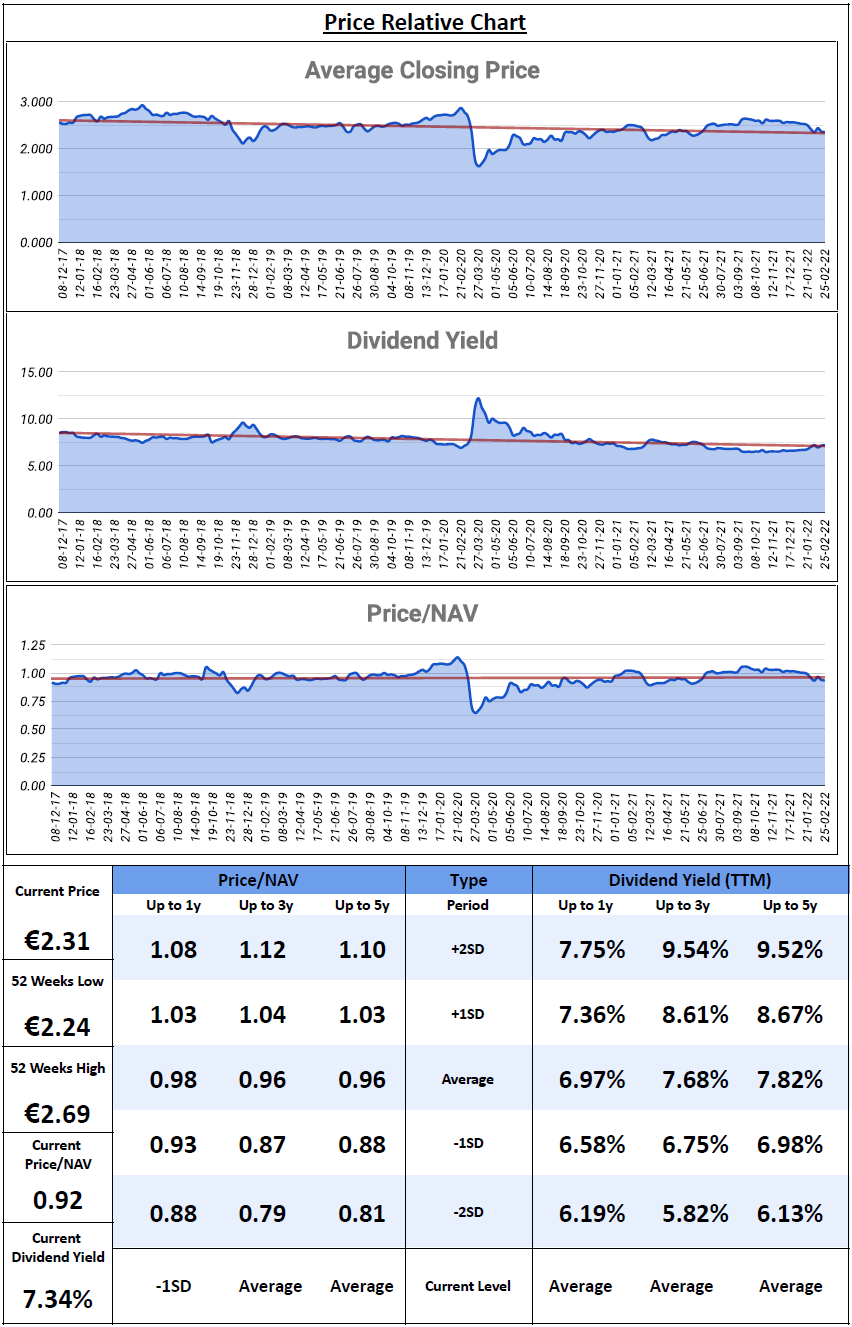

Relative Valuation

- P/NAV - Below -1SD for 1y; Average for 3y and 5y

- Dividend Yield - Above average for 1y; Average for 3y; Below average for 5y

Author's Opinion

| Favorable | Less Favorable |

|---|---|

| Diversified Sector | Low REIT Manager's Shareholding |

| Long Weighted Average Land Lease Expiry | Low Directors of REIT Manager's Shareholding |

| Low Cost of Debt | Concentrated Lease Expiry |

| 100% Fixed Rate Debt | Concentrated Debt Maturity |

| High Unsecured Debt % | DPU Downtrend |

| Long WADM | NAV per Unit Downtrend |

| High Interest Coverage Ratio | Interest Coverage Ratio Downtrend |

| Low Top Geographical Contribution | Property Yield Downtrend |

| Low Top Property & Top 5 Properties Contributions | Distribution on Capital Downtrend |

| Low Top 10 Tenants Contribution | Distribution Margin Downtrend |

| Competitive Management Fees | |

| High Distribution on Capital |

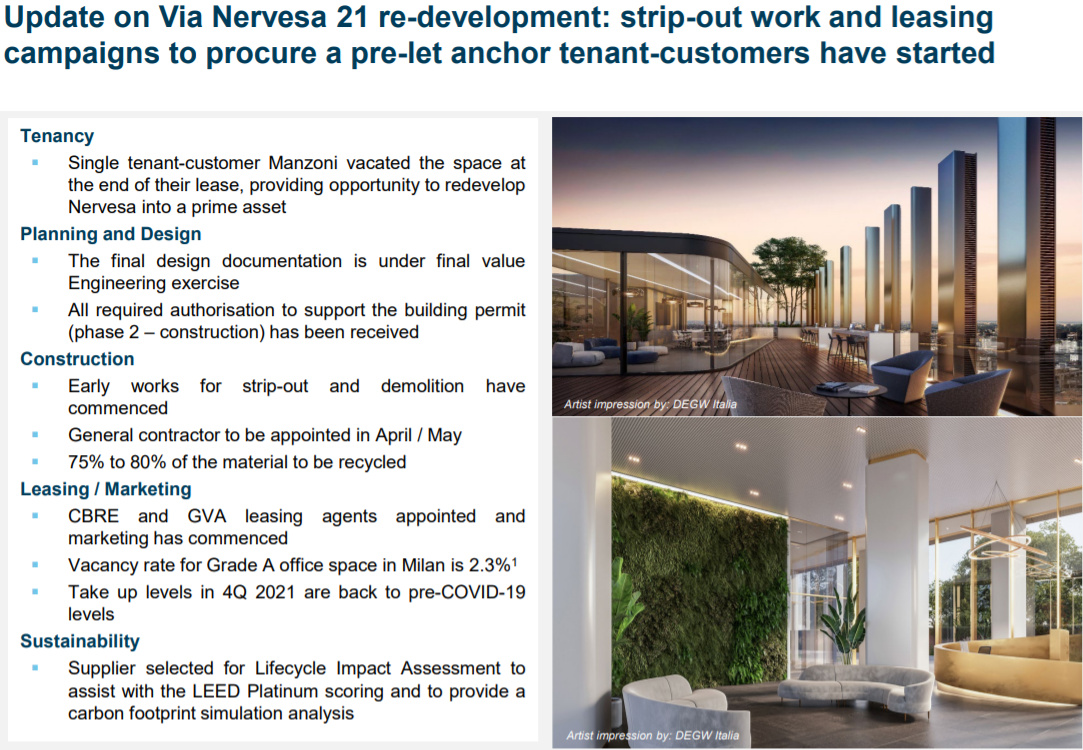

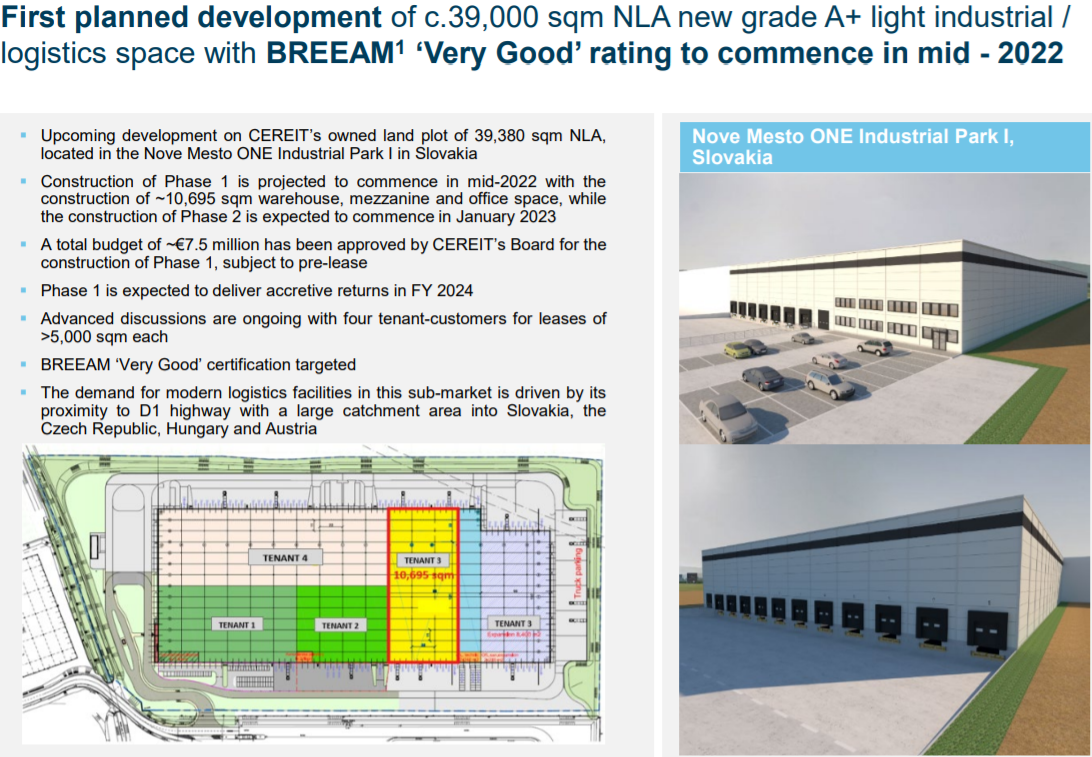

For the first time, CEREIT has present their development projects of around €250 million. Development projects generally provided higher yield and cost but it would take longer time to be fruitful. Moving forward, the contribution from the 4 newly acquired properties should improve the performance of CEREIT, albeit slightly, given the current AUMs of CEREIT.

You could also refer below for more information:

SREITs Dashboard - Detailed information on individual Singapore REIT

SREITs Data - Overview and Detail of Singapore REIT

REIT Analysis - List of previous REIT analysis posts

Singapore REITs Post Telegram Channel - Join to receive posts for Singapore REITs

REIT-TIREMENT Patreon - Support my work and get exclusive contents

REIT-TIREMENT Facebook Page - Support by liking my Facebook Page

REIT Investing Community - Facebook Group where members share and discuss REIT topic

*Disclaimer: Materials in this blog are based on my research and opinion which I don't guarantee accuracy, completeness, and reliability. It should not be taken as financial advice or a statement of fact. I shall not be held liable for errors, omissions and loss or damage as a result of the use of the material in this blog. Under no circumstances does the information presented on this blog represent a buy, sell, or hold recommendation on any security, please always do your own due diligence before any decision is made.

No comments:

Post a Comment