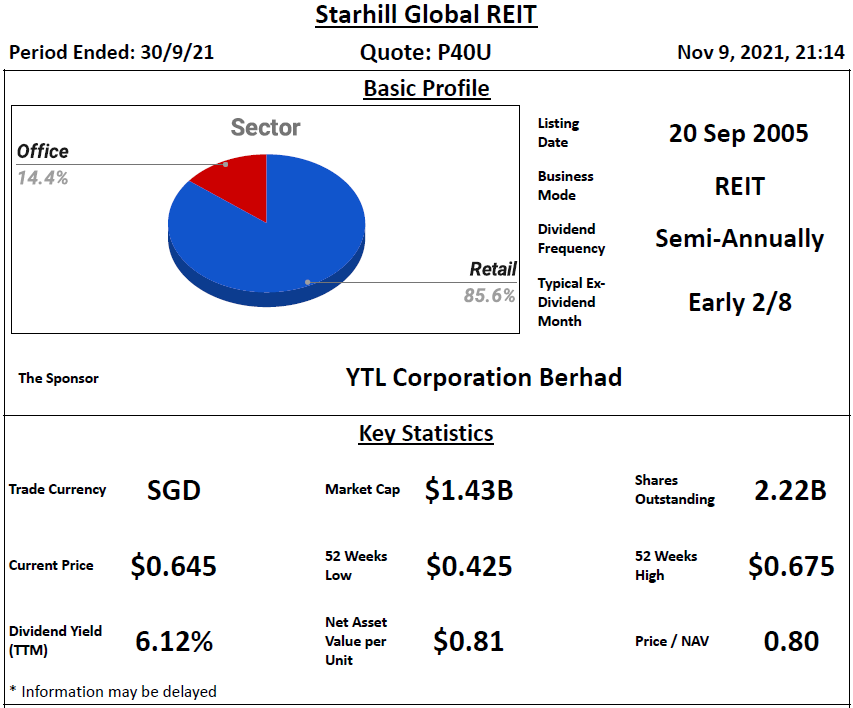

Basic Profile & Key Statistics

Performance Highlight

Related Parties Shareholding

- REIT sponsor's shareholding is high at 37.798%

- REIT manager's shareholding is high at 1.906%

- Directors of REIT manager's shareholding is low at 0.007%

Lease Profile

- Occupancy is slightly high at 96.8%

- WALE is long at 5.1 years

- Highest lease expiry within 5 years is high at 33.6% which falls in FY24/25 and beyond, without breakdown

- Weighted average land lease expiry is moderate at 62.01 years

Debt Profile

- Gearing ratio is moderate at 36.3%. Include perpetual securities, gearing is at 39.8%.

- Cost of debt is high at 3.18%

- Fixed rate debt % is high at 96%

- Unsecured debt % is slightly high at 84.6%

- WADM is long at 3.7 years

- Highest debt maturity within 5 years is low at 23% which falls in FY25/26

- Interest coverage ratio is low at 3 times

- Preferred/Perpetual Securities over Debts is moderate at 8.3%

Diversification Profile

- Top geographical contribution is high at 62.8%

- Top property contribution is high at 35.3%

- Top 5 properties contribution is high at 91.3%

- Top tenant contribution is high at 22.4%

- Top 10 tenants contribution is high at 59.1%

- Top 3 countries contribution is from Singapore, Australia and Malaysia which contribute more than 95% of GRI

Key Financial Metrics

- Property yield is slightly low at 4.7%

- Management fees over distribution is high at 17.7% in which unitholders receive S$ 5.65 for every dollar paid

- Distribution on capital is low at 2.9%

- Distribution margin is moderate at 48.2%

Trends

- Downtrend - DPU, NAV per Unit, Interest Coverage Ratio, Property Yield, Distribution on Capital, Distribution Margin

Relative Valuation

- P/NAV - Above +1SD for 1y; Above average for 3y and 5y

- Dividend Yield - Average for 1y, 3y and 5y

Author's Opinion

| Favorable | Less Favorable |

|---|---|

| Diversified Sector | Low Directors of REIT Manager's Shareholding |

| High REIT Sponsor's Shareholding | High Cost of Debt |

| High REIT Manager's Shareholding | Low Interest Coverage Ratio |

| Long WALE | High Top Geographical Contribution |

| High Fixed Rate Debt % | High Top Property & Top 5 Properties Contributions |

| Long WADM | High Top Tenant & Top 10 Tenants Contributions |

| Well Spread Debt Maturity | Non-Competitive Management Fees |

| Low Distribution on Capital | |

| DPU Downtrend | |

| NAV per Unit Downtrend | |

| Interest Coverage Ratio Downtrend | |

| Property Yield Downtrend | |

| Distribution on Capital Downtrend | |

| Distribution Margin Downtrend |

The gross revenue has dropped slightly as compared to the previous quarter but the NPI is similar. The COVID-19 restriction (stabilization phase from 27 Sep to 21 Nov) in Singapore is expected to continue to affect the performance. However, with the possible easing of restriction and border re-opening to more countries, performance should be improved moving forward.

Join REIT-TIREMENT Patreon for patron-exclusive posts that cover REITs valuation and more detail on fundamental analysis. You could also refer below for more information:

SREITs Dashboard - Detailed information on individual Singapore REIT

SREITs Data - Overview and Detail of Singapore REIT

REIT Analysis - List of previous REIT analysis posts

REIT-TIREMENT Telegram Channel - Join to receive updates on new post

REIT-TIREMENT Facebook Page - Support by liking my Facebook Page

REIT Investing Community - Facebook Group where members share and discuss REIT topic

*Disclaimer: Materials in this blog are based on my research and opinion which I don't guarantee accuracy, completeness, and reliability. It should not be taken as financial advice or a statement of fact. I shall not be held liable for errors, omissions and loss or damage as a result of the use of the material in this blog. Under no circumstances does the information presented on this blog represent a buy, sell, or hold recommendation on any security, please always do your own due diligence before any decision is made.

No comments:

Post a Comment