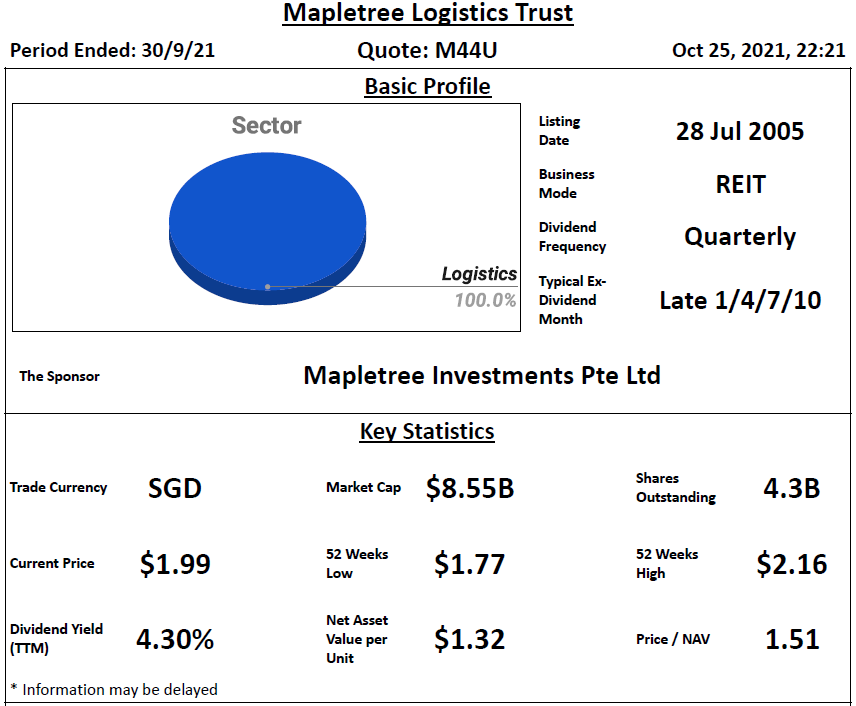

Basic Profile & Key Statistics

Performance Highlight

Related Parties Shareholding

- REIT sponsor's shareholding is high at 31.221%

- REIT manager's shareholding is low at 0.054%

- Directors of REIT manager's shareholding is low at 0.02%

Lease Profile

- Occupancy is high at 97.8%

- Income in SGD/Major Currencies is low at 47.9%.

- WALE is moderate at 3.7 years

- Highest lease expiry within 5 years is slightly high at 28.5% which falls in FY22/23

- Weighted average land lease expiry is slightly short at 55.08 years

Debt Profile

- Gearing ratio is moderate at 38.2%. Include perps, gearing is at 42.1%.

- Cost of debt is low at 2.2%

- Fixed rate debt % is moderate at 76%

- Unsecured debt % is high at 91.3%

- WADM is long at 3.6 years

- Highest debt maturity within 5 years is low at 20% which falls in FY23/24

- Interest coverage ratio is high at 5.2 times

- Preferred/perpetual securities over debt is moderate at 9.3%

Diversification Profile

- Top geographical contribution is low at 30.1%

- Top property contribution is low at 9.1%

- Top 5 properties contribution is low at 22.1%

- Top tenant contribution is low at 7.3%

- Top 10 tenants contribution is low at 25.8%

- Top 3 countries contribution is from Singapore, Hong Kong and China which contribute around 2/3 of GRI

Key Financial Metrics

- Property yield is moderate at 5.2%

- Management fees over distribution is high at 19.7% in which unitholders receive S$ 5.08 for every dollar paid

- Distribution on capital is moderate at 3.6%

- Distribution margin is high at 55.9%

- 1.9% of DPU is from distribution from asset disposal (exclude 5 divested properties in Japan and 7 Tai Seng Drive)

Trends

- Uptrend - DPU, NAV per Unit, Distribution Margin

- Flat - Distribution on Capital

- Downtrend - Interest Coverage Ratio, Property Yield

Relative Valuation

- P/NAV - Average for 1y & 3y; Above average for 5y

- Dividend Yield - Above average for 1y; Below average for 3y; Below -1SD for 5y

Author's Opinion

| Favorable | Less Favorable |

|---|---|

| High REIT Sponsor's Shareholding | Low REIT Manager's Shareholding |

| High Occupancy | Low Directors of REIT Manager's Shareholding |

| Low Cost of Debt | Low Income in SGD/Major Currencies |

| High Unsecured Debt % | Non-Competitive Management Fees |

| Long WADM | Interest Coverage Ratio Downtrend |

| Well Spread Debt Maturity | Property Yield Downtrend |

| High Interest Coverage Ratio | |

| Low Top Geographical Contribution | |

| Low Top Property & Top 5 Properties Contributions | |

| Low Top Tenant & Top 10 Tenants Contributions | |

| High Distribution Margin | |

| DPU Uptrend | |

| NAV per Unit Uptrend | |

| Distribution Margin Uptrend |

MLT fundamentals remain solid and continue to deliver a good quarter performance. With the positive rental reversion and announced acquisitions which are targeted to complete by this year end, its performance should be improved moving forward.

Join REIT-TIREMENT Patreon for patron-exclusive posts that cover REITs valuation and more detail on fundamental analysis. You could also refer below for more information:

SREITs Dashboard - Detailed information on individual Singapore REIT

SREITs Data - Overview and Detail of Singapore REIT

REIT Analysis - List of previous REIT analysis posts

REIT-TIREMENT Telegram Channel - Join to receive updates on new post

REIT-TIREMENT Facebook Page - Support by liking my Facebook Page

REIT Investing Community - Facebook Group where members share and discuss REIT topic

*Disclaimer: Materials in this blog are based on my research and opinion which I don't guarantee accuracy, completeness, and reliability. It should not be taken as financial advice or a statement of fact. I shall not be held liable for errors, omissions and loss or damage as a result of the use of the material in this blog. Under no circumstances does the information presented on this blog represent a buy, sell, or hold recommendation on any security, please always do your own due diligence before any decision is made.

ReplyDeleteThanks and I benefitted from your Good analysis and well written article :) Will you be doing similar analysis for MIT, MCT and MNACT ? Any plan for Ascendas Reit 3QFY21 business update analysis ?

Thanks for your compliment. Will definitely review MIT MCT & MNACT. But would not review AREIT this time as no performance information in business update.

Delete