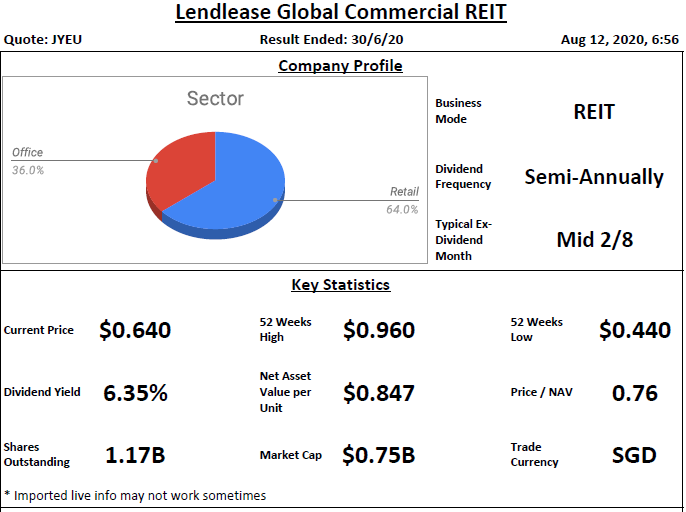

Basic Profile & Key Statistics

Lendlease Global Commercial REIT (LREIT) invests in Retail and Office Properties. Currently LREIT only invests in 2 properties which are 313@somerset in Singapore and Sky Complex in Milan.

Lease Profile

Occupancy is High at 99.5%. WALE is long at 4.9 years where highest lease expiry within 5 years of 23% falls in FY 2023. Weighted average land lease expiry is long at 89.19 years.

Debt Profile

Gearing ratio is healthy at 35.1%. Cost if debt is very low at 0.9%, it is the second lowest for SREITs. Fixed rate debt and unsecured debt are max. at 100%. Interest cover ratio is high at 4.6 times. Weighted average debt maturity is slightly high at 3.1 years where highest debt maturity of 84.3% falls in FY2024. This posts a very concentrated debt maturity risk.

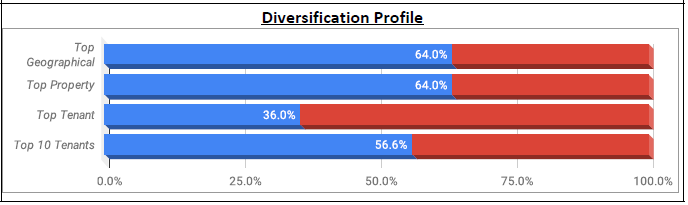

Diversification Profile

With only 2 properties, LREIT is hardly diversified. Its top geographical, top property, top tenant and top 10 tenants contribute high percentage at 64%, 64%, 36%, 56.6% respectively.

Key Financial Metrics

Property is low at 3.8%. Management fee is moderate in which unitholders receive S$7.19 for every dollar paid. Distribution on capital is moderate at 3.2%. Distribution margin is high at 64.3%

Related Parties Shareholding

As compare to SREITs median level, manager holding lesser stake while directors of REIT manager holding higher stake. Sponsor holding is close to SREITs median level.

Trend

As LREIT has only listed for 3 quarters, the trend is less meaningful. NAV per unit increase slightly in latest quarter. DPU and distribution margin decreased in latest quarter due to rental relief provided for eligible tenants at 313@Somerset.

Relative Valuation

i) Average Dividend Yield - Dividend yield of 6.35% is based on annualized DPU for the past 3 quarters. Apply annualized DPU of 4.067 cents to average yield of 4.94% will get S$ 0.815.

ii) Average Price/NAV - Average value is at 0.96 , apply latest NAV of S$ 0.847 will get S$ 0.815.

Author's Opinion

| Favorable | Less Favorable |

| Diversified Sector | Concentrated Debt Maturity |

| Occupancy | Top Geographical Contribution |

| WALE | Top Property Contribution |

| Weighted Average Land Lease Expiry | Top Tenant & Top 10 Tenants Contribution |

| Cost of Debt | Property Yield |

| Unsecured Debt | |

| Interest Cover Ratio | |

| Distribution Margin |

LREIT performance has been hit hard by COVID, but we can see the crowd is coming back for 313@Somerset. Besides not diversified and very concentrated debt maturity in FY2024 (seriously, very very concentrated), LREIT is fine in other areas. Though it always puzzles me that, Lendlease Corporation Limited being a sponsor with such big pipelines, why don't they listed LREIT with more quality properties to improve its diversification? I believe a lot of people would be excited if LREIT would include JEM and Payer Lebar Quarter in its portfolio. Will LREIT going to acquire properties frequently to grow? Only time will tell.

No comments:

Post a Comment