Basic Profile & Key Statistics

Dasin Retail Trust (DRT) is listed as Business Trust but operates similar to REIT. DRT invests in 7 retail properties in Guangdong province, China. Share outstanding is as per the end of June 2020, without adding new units from private placement in July 2020 for the acquisition of 2 properties.

Lease Profile

Occupancy is slightly high at 97% and income is received in RMB. WALE is moderate at 4 years where the highest lease expiry of 29.9% falls in FY2025 & beyond, no breakdown provided. Weighted average land lease expiry is short at 23.66 years, common for China properties.

Debt Profile

Gearing ratio is slightly high at 37.9%. Cost of debt is high at 5.5% despite all debts are secured debt. Fixed rate is low at 30.1% which is favorable in the current low interest environment. Interest cover ratio is low at 2.3 times. WADE is short at 1.95 years where the highest least maturity of 71% falls in the year 2021.

Diversification Profile

All of DRT properties is located in Guangdong province, as such top geographical constribution is 100%. Top property contribution is high at 31.7%. Top tenant contribution is moderate at 10.6% and top 10 tenants contribution is high at 40.9%.

Key Financial Metrics

Property yield, distribution on capital and distribution margin are low at 3.4%, 1.4% and 18%. Management fee is high in which unitholders receive S$ 4.17 distribution for every dollar paid. For 1H 2020, 29.5% of its distribution is from income support through distribution waiver arrangement.After private placement in July, this would reduce to 25%. This distribution waiver arrangement would end in 4Q 2021.

Related Parties Shareholding

As compared to SREITs median, REIT manager and directors of REIT manager holding higher stake while sponsor hold no stake.

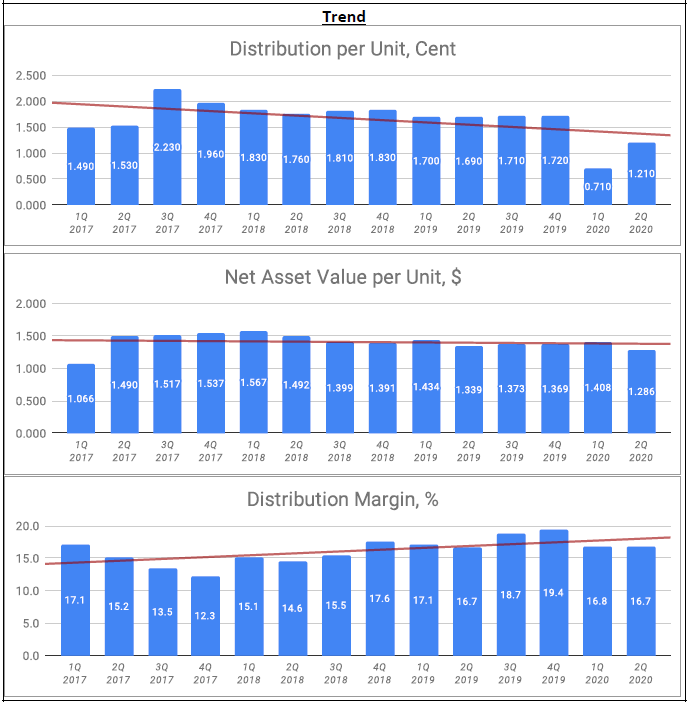

Trend

If we consider pre-COVID time, DPU is on a slight downtrend due to the distribution waiver arrangement in which certain unitholders wouldn't receive distribution. NAV per unit is on a slight downtrend. Distribution margin is on uptrend.

Relative Valuation

i) Average Dividend Yield - Average yield at 7.85%, apply the past 4 quarters DPU of 5.35 cents will get S$ 0.68.

ii) Average Price/NAV - Average value is at 0.6, apply the latest NAV of S$ 1.286 will get S$ 0.77.

Author's Opinion

| Favorable | Less Favorable |

|---|---|

| Distribution Margin Uptrend | Income Received in RMB |

| Weighted Average Land Lease Expiry | |

| Cost of Debt | |

| Unsecured Debt | |

| Interest Cover Ratio | |

| WADE | |

| Concentrated Debt Maturity | |

| Top Geographical Weightage | |

| Top Property Weightage | |

| Top 10 Tenants Weightage | |

| Property Yield | |

| Distribution on Capital | |

| Management Fee | |

| Distribution Margin | |

| Income Support (Distribution Waiver) |

DRT 1H performance is greatly affected by COVID in which operating hours have been reduced from end of January. In early March, all DRT properties have resumed normal operating hours. DRT recently in July just completed the acquisition of Shunde Metro Mall and Tanbei Metro Mall, funded through private placement, which both are in Guangdong province as well.

For more information, you could refer:

SREITs Dashboard - Detailed information on individual Singapore REIT as well as summary

SREITs Data - Overview of Singapore REIT

REIT Analysis - List of previous REIT analysis posts

REIT Investing Community - Facebook Group where members share and discuss REIT topic

*Disclaimer: Materials in this blog are based on my research and opinion which I don't guarantee the accuracy, completeness, and reliability. It should not be taken as financial advice or statement of fact. I shall not be held liable for errors, omissions as well as loss or damage as a result of the use of the material in this blog. Under no circumstances does the information presented on this blog represent a buy, sell, or hold recommendation on any security, please always do your own due diligence before any decision is made.

No comments:

Post a Comment